Inheritance Tax on pensions set to change: Could it mean an 87% tax charge for you?

21st October 2025

Individuals are being urged to prepare for significant changes to the way pensions are to be treated under Inheritance Tax (IHT).

Currently, when someone dies, the first £325,000 of their estate is tax-free under the Nil Rate Band (NRB). If they leave their home to direct descendants (like children or grandchildren), they may also benefit from an extra £175,000 tax-free allowance called the Residence Nil Rate Band (RNRB). However, for estates worth more than £2 million, the RNRB is gradually reduced and can be lost entirely.

From 6 April 2027, unused defined contribution (DC) pensions will be included in an individual’s estate for IHT purposes. This means that if someone dies with pension savings still in place, those funds could be taxed at 40%, just like other assets such as property or investments. For families with large estates, especially where the RNRB is tapered away, this change could result in a combined tax burden of up to 87% on unspent pension savings.

Key changes to IHT on pensions

- Unused pension funds to be taxed – From April 2027, any unused pension funds will be included in the value of an individual’s estate for IHT purposes.

- Responsibility shift – personal representatives (those managing the deceased’s estate) will be responsible for declaring and paying any IHT due, rather than pension scheme providers.

- Provider support – Pension providers must still supply relevant information to assist with IHT reporting.

- Exemptions – Certain benefits remain exempt, including lump sum death-in-service benefits, joint annuities, dependants’ pensions and charity lump sums.

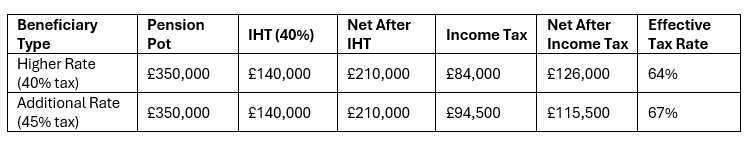

Tax breakdown

For estates that have already used their nil-rate bands, the pension pot will be taxed at 40% IHT. Additionally, if the deceased was over 75, beneficiaries will also pay income tax on withdrawals at their marginal income tax rate. This combination can result in an effective tax rate of up to 67%. See table below:

A worst-case scenario – an 87% charge

In cases where the pension pot pushes the estate value above £2 million, the Residence Nil Rate Band (RNRB) is tapered and potentially lost. This results in an additional IHT charge of £70,000, bringing the total tax on a £350,000 pension pot to £304,500 – an effective rate of 87%*.

Who will be impacted?

The Government estimates around 10,500 additional estates each year will be impacted.

Jonathan Watts-Lay, Director, WEALTH at work, comments; “The introduction of IHT on pensions could result in substantial tax charges for some. Those most likely to be affected are individuals with larger pension pots, especially if those savings were intended to be passed on to family.”

He adds; “Rising living costs, longer retirements, and care expenses could mean that many pensions are used up during retirement, so it won’t be an issue for all. However, people will need to review their individual circumstances.”

What should you do?

Watts-Lay comments; “At this stage if you haven’t already retired, no immediate action is needed. The focus should remain on making sure your pension provides the best possible income for your retirement, while keeping tax bills as low as possible. The rules are still in draft form and won’t take effect until April 2027. As that date approaches, it would be a good idea to review your situation. However, for those who have already retired and have additional savings beyond their pension, a shift in thinking and strategy could be beneficial. From an IHT perspective, it could now be better to spend pension savings first and preserve other assets for later on. This is the opposite approach to what has previously been the case. That said, people will need to review their individual circumstances and seek guidance and advice.”

He adds; “Many employers provide financial education and guidance in the workplace to help people understand their pensions including tax efficiency. Also, they can provide you with access to regulated financial advice. This can help those who need it take the appropriate steps to reduce IHT by adjusting how they draw their pension or using other tax-efficient strategies. It’s always worth speaking to your employer to find out what support they provide to help staff improve their finances.”

*Example of an 87% charge

The following example presumes the individual was over the age of 75 upon death

Estate

- Home worth at least £175,000, left to direct descendants

- Other assets: £1.825 million

- Total estate excluding the pension pot: £2 million

- Unspent DC pension pot: £350,000

The inclusion of the unspent DC pension pot increases the total estate value above £2 million, causing the RNRB to be tapered by £1 for every £2 above the threshold. As a result, the entire RNRB (£175,000) is lost.

Impact of RNRB Loss

- The full loss of the RNRB triggers an additional IHT liability on the estate.

IHT Calculation on Pension Fund

- Pension fund subject to IHT: £350,000

- IHT at 40%: £350,000 × 40% = £140,000

- Net pension fund after IHT: £350,000 – £140,000 = £210,000

Income Tax on Pension Fund

- Income tax at 45% (additional rate beneficiary): £210,000 × 45% = £94,500

- Net pension fund after income tax: £210,000 – £94,500 = £115,500

Total Tax on Pension Fund

- IHT: £140,000

- Income tax: £94,500

- Combined tax: £140,000 + £94,500 = £234,500

Tax Charge Created by the Loss of the RNRB

The inclusion of the unspent DC pension pot in the estate results in the full loss of the RNRB. This means that the £175,000 that would have been covered by the RNRB is now subject to IHT at 40%:

- Additional IHT charge due to RNRB loss: £175,000 × 40% = £70,000

Final Total Tax Burden

- Combined tax (IHT + income tax): £234,500

- Additional IHT charge due to RNRB loss: £70,000

- Total tax: £304,500

Final Effective Tax Rate

- £304,500 ÷ £350,000 = 87.0%

Copyright 2026 Wealth at Work Limited. All rights reserved. Privacy Policy